Volatility, disruptions, and uncertainty in the PV supply chain have become the norm during 2021 and early 2022, and these themes have continued unabated during Q2 2022. Here we take a brief look at some key takeaways from the ever-changing market that are covered in depth in PVEL’s and Exawatt’s Q2 2022 Solar Technology and Cost (STAC) report.

Input prices remain as volatile as ever

Polysilicon prices are remaining high, with delays of some polysilicon capacity expansions, disruption to imports, and strong demand all exacerbating the ongoing supply/demand imbalance. Moving into Q3, prices are likely to rise even further due to disruption from a fire at a polysilicon facility in Xinjiang and maintenance at other facilities as a result of this.

However, it’s not all bad news for module buyers! Elsewhere there has been some relief, with aluminum prices dropping off significantly from their peak in Q1 2022, and shipping spot prices continuing to decline meaningfully.

Technology transition continues to edge closer

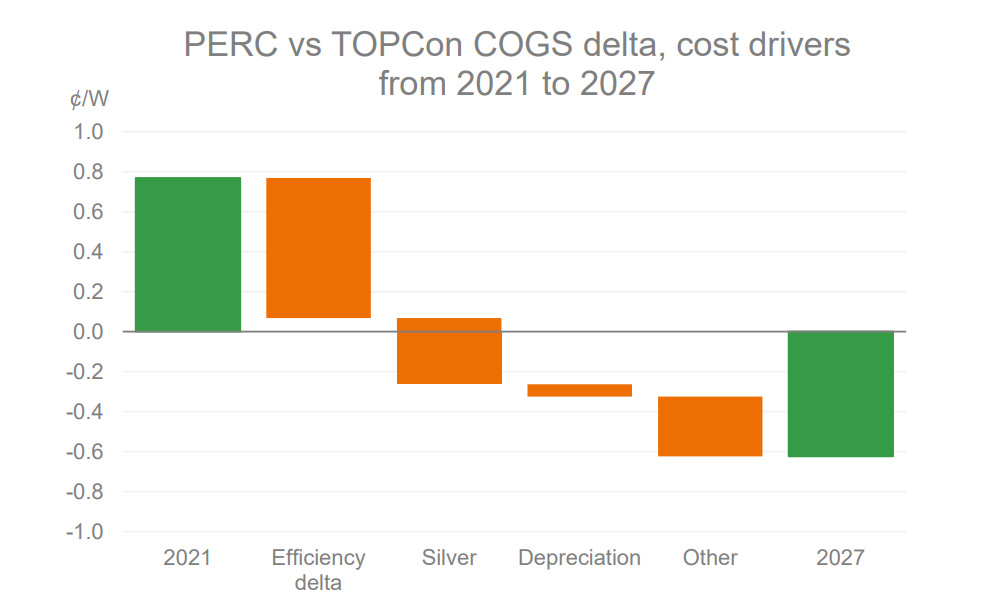

Moves toward the next generation of modules are continuing, with major manufacturers such as JA Solar and Jinko announcing new or increased TOPCon (tunnel oxide passivated contact) cell capacity expansions for 2022 and 2023. Exawatt’s bottom-up cost modelling suggests that by the end of 2024 leading integrated manufacturers may be able to achieve a module cost of goods sold (COGS) for TOPCon of ~0.2 ¢/W below that of PERC. Once COGS parity is reached, we expect a major market shift to occur due to both the higher efficiency of TOPCon modules vs. their PERC counterparts, and other system-level advantages such as higher bifaciality, improved temperature coefficient, improved low-light performance, and the potential for reduced LID.

The outlook for HJT (heterojunction) technology is currently less certain, and in order for HJT to achieve cost per watt parity with TOPCon, we believe that HJT will need to both establish a meaningful lead in module efficiency and make cost savings beyond those currently modelled in our forecasts.

Waterfall graph showing module COGS delta for TOPCon vs mono PERC in 2021 and 2027 and what the key drivers of change will be. These drivers include a growing efficiency delta between the two technologies, reduced silver usage for TOPCon, reduced equipment CapEx (depreciation) for TOPCon, and other improvements (e.g., improvements in n-type ingot manufacturing and cell manufacturing yield).

U.S. policy continues to evolve – bringing challenges and opportunities

In the United States, trade uncertainty caused by the anti-circumvention investigation into manufacturers producing cells and modules in Southeast Asia has briefly eased after the Biden administration declared a 24-month “bridge” tariff exemption and invoked the Defense Production Act (DPA) to drive domestic solar development.

However, the Uyghur Forced Labor Prevention Act (UFLPA) went into effect June 21, 2022, providing guidelines for restrictions on imports from the Xinjiang Uyghur Autonomous Region (XUAR). Whereas the previous traceability requirement for the Withhold Release Order (WRO) for Hoshine products was largely at the level of polysilicon, the UFLPA will require traceability down to sourcing quartzite, the raw material that goes into the making of metallurgical-grade silicon (MG-Si), in order to release modules from detention. The outlook for the impact of this is not yet entirely clear, but it may delay some module imports significantly.

There is significant interest in establishing U.S.-based manufacturing from a variety of parties – both current PV manufacturers and possible new players. If the manufacturing incentives in the Solar Energy Manufacturing for America (SEMA) Act are passed by the U.S. Government government, we believe that there is potential for major growth in U.S.-based manufacturing capacity and the associated supply chains.

What is the Solar Technology and Cost Forecast Report (STAC)?

STAC is a subscription-based service that aims to provide an informed forecast of PV module efficiency, form factor and price for a rolling quarterly window looking forward three years. Our methodology leverages bottom-up cost analysis, based on data gathered from over 100 publicly traded companies throughout the PV module supply chain, combined with a manufacturing facility operations model that contains over 250 input variables. PVEL and Exawatt also incorporate manufacturer-reported top-down forecasts and industry trends observed over the past 10+ years, as well as findings from PVEL’s testing for the PV Module Product Qualification Program.

Next Steps

PVEL and Exawatt’s STAC report helps project developers and investors assess the technology roadmap and supply/demand dynamics for the PV module market.

Ready to learn more? Contact PVEL to request a sample STAC report or sign up as a subscriber.

About the Authors

Sishir Garemella is Head of International Business Development at PV Evolution Labs (PVEL). He is responsible for the company’s expansion in strategic global markets. Sishir is based in Delhi NCR and has over 10 years of experience as a downstream solar player, both as a financier and as an operator.

Alex Barrows is Head of PV at Exawatt, and is focused on forecasting the efficiency and cost evolution of solar technologies. Alex is based in Sheffield, England, and has a PhD in perovskite solar cells.