Over the past decade, solar module prices have trended downward as technology has improved. Until recently, solar developers in many global markets could usually count on PV module prices decreasing steadily over time. Past price declines were driven by decreases in the underlying module cost of goods sold (COGS) in $/W due to materials cost declines, improved manufacturing processes, and higher module efficiencies.

To the dismay of many solar industry professionals, 2021 presented the unusual situation in which average PV module prices increased, driven by higher underlying costs. In contrast to past price increases, this trend was observed globally and not only in specific markets subject to tariffs/duties or other regulatory trade constraints, as has frequently occurred in the past.

PV module prices jumped in 2021 for a few key reasons:

- A supply/demand imbalance built up in the polysilicon market, exacerbated by rapid wafer capacity expansions at both manufacturers and new market entrants. This imbalance pushed polysilicon prices steadily higher through the first half of 2021.

- Energy rationing in China in late Q3 and early Q4 led to a further round of polysilicon price rises, driven by a temporary 400% increase in the price of the metallurgical silicon used as feedstock for polysilicon manufacturing.

- Numerous commodities prices increased, with aluminum price hikes pushing frame costs higher and increases in the cost of natural gas putting upward pressure on PV glass prices. With PV module costs now dominated by raw materials, improvements in technology and production efficiency were insufficient to offset these impacts from the broader economy.

- Shipping costs increased hugely, driven by COVID-related disruptions and shifts in demand.

Can we expect the upward trend in module prices to continue in 2022? If so, will higher-price products deliver better technology? We answer these important questions in the Solar Technology and Cost Forecast Report, a quarterly report that is jointly produced by PV Evolution Labs (PVEL) and Exawatt.

What is the Solar Technology and Cost Forecast Report (STAC)?

STAC is a subscription-based service that aims to provide an informed forecast of PV module efficiency, form factor and price for a rolling quarterly window looking forward three years. Our methodology leverages bottom-up cost analysis, based on data gathered from over 100 publicly traded companies throughout the PV module supply chain, combined with a manufacturing facility operations model that contains over 250 input variables. PVEL and Exawatt also incorporate manufacturer-reported top-down forecasts and industry trends observed over the past 10+ years, as well as findings from PVEL’s testing for the PV Module Product Qualification Program.

We’ve summarized our top 3 findings for PV module buyers from the latest edition of STAC below.

1. Increasing wafer size

The PV industry is transitioning toward larger wafers. From 2018 to 2019, the market transitioned from wafer side lengths of 156.75 mm (M2) to 158.75 mm. More recently, there has been faster adoption of even larger wafers such 166 mm (M6), 182 mm (M10) and 210 mm (G12). Moving into 2022, we expect M6 to lose market share to its larger competitors (M10 and G12) due to savings on module COGS, electrical balance of systems, labor and trackers. The U.S. has lagged behind other markets in this transition, in part due to its reliance on cell and module factories outside China. Based on our research and market interviews, we expect M10 and G12 to take ~ 60% market share in the U.S. by the end of 2022 and as high as ~ 85% by end of 2024.

Larger modules with higher power classes represent an exciting advancement for the industry, but a few words of caution are prudent: as is the case for many new PV technologies, the industry lacks field data that proves large-format modules will perform reliably for 25+ years in operating assets. PVEL’s initial lab test results suggest some large-format module designs are more susceptible to damage from thermo-mechanical stress and mechanical loading.

It is likely that operating large-format modules in desert environments and high-wind and heavy snow conditions heightens the risk of microcracks forming in solder joints over time. Microcracks can spur localized hotspots and other failure modes that ultimately reduce energy yield and affect project safety. Asset owners who are deploying the latest large-format PV technologies should leverage PVEL’s Product Qualification Programs (PQPs) to mitigate risks.

2. Decreasing module prices

Looking at a three-year horizon from Q1 2022, we expect PV module pricing to drop and stabilize. The reduction in pricing is driven by several factors: the decline of polysilicon prices from their current exceptionally high levels (driven by rapidly expanding polysilicon manufacturing capacity); structural cost reductions by increasing the proportion of consumables and materials produced in-house; and continued process advancements in ingot, wafer and cell manufacturing.

Furthermore, we expect the efficiency of PERC modules will also continue to increase, driving down module cost-per-watt, although efficiency gains for PERC will begin to slow in the coming years. From our analysis we expect prices for monofacial and bifacial PERC modules to decrease over the next eight quarters, with a 25-30% decrease in the U.S. as tariffs step down. We expect prices to stabilize for the next few quarters following Q4 2023.

3. Growth of new cell architectures

Over the years, the solar industry has shifted from the aluminium back surface field (Al-BSF) cell architecture to PERC, with both technologies typically based on p-type wafers. However, the industry has been working on higher-efficiency cell technologies, with the two main contenders being tunnel oxide passivated contact (TOPCon) and heterojunction (HJT). Both of these technologies are historically based on n-type wafers, and until recently have seen limited adoption due to higher manufacturing costs.

Our modelling suggests module COGS for TOPCon will reach parity with mono PERC on a cost-per-watt basis around 2024, with HJT likely to remain slightly more expensive unless its cell efficiency begins to pull away from that of TOPCon. Once cost parity is reached, we expect LCOE advantages such as higher efficiencies, improved temperature coefficients and higher bifaciality to drive rapid a rapid transition away from PERC.

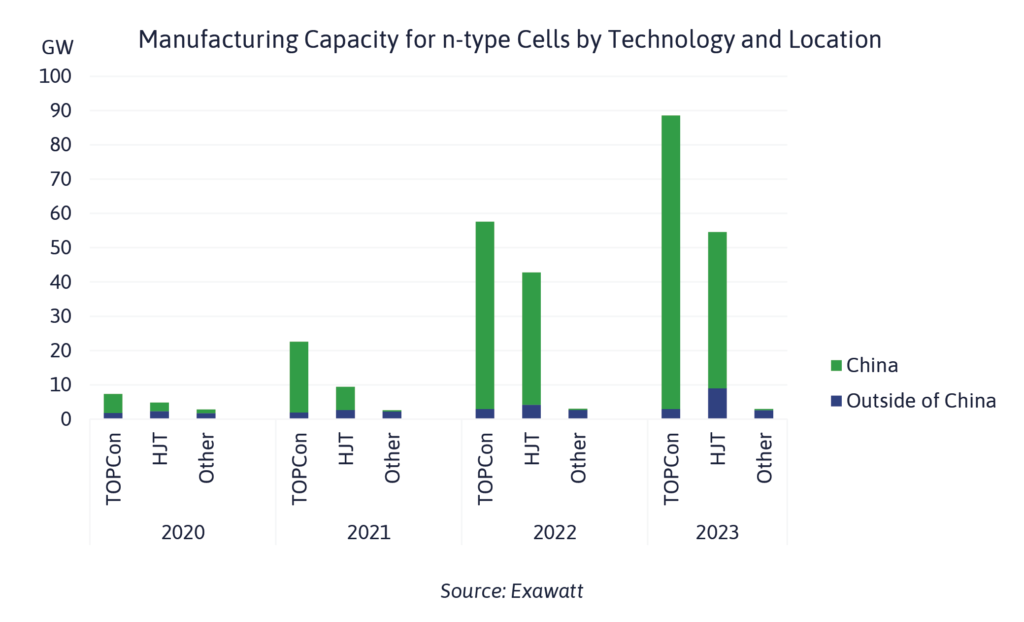

As shown in the chart below, significant capacity expansions for TOPCon and HJT cell lines are due to come online in 2022 and 2023 in China. We expect other manufacturing locations such as South East Asia and India will follow over the next few years.

Capacity expansion plans for n-type technologies are currently focused on Chinese manufacturing locations.

Next Steps

PVEL and Exawatt’s STAC report helps project developers and investors assess the technology roadmap and supply/demand dynamics for the PV module market.

Ready to learn more? Contact PVEL to request a sample STAC report or sign up as a subscriber.

About the Authors

Sishir Garemella is Head of International Business Development at PV Evolution Labs (PVEL). He is responsible for the company’s expansion in strategic global markets and he also supports the growth of inverter, battery and power electronics businesses. Sishir is based in Mumbai and has over 10 years of experience as a downstream solar player, both as a financier and as an operator.

Alex Barrows is Head of PV at Exawatt, and is focused on forecasting the efficiency and cost evolution of solar technologies. Alex is based in Sheffield, England, and has a PhD in perovskite solar cells.